Content

- Single Step Vs Multi Step Income Statement: Which One Should I Use?

- Types Of Financial Statements That Every Business Needs

- #3 Sum The Revenues

- What Is The Difference Between A Single Step And A Multi

- One More Step

- Non Operating Income:

- What Is The Difference Between A Multiple

- Operating Income = Gross Profit

- Why Your Business Needs Help Understanding The Tax Code

- Small Business

- Financial Market: All You Should Know With Practical Examples + Free Pdfs

- Watch Your Business Grow With Wise

Investopedia does not include all offers available in the marketplace.

- This is usually worded as “for the year/quarter/month ended xyz date”.

- A multi-step income statement is an income statement preparation method where the same information represented on the single-step income statements is included and more detailed.

- However, this format could miss leading users of income statement especially for non-accounting experiences users because this format treats all kinds of revenues into only one section.

- Many financial decisions do require more information about a business’s financial health than net income alone can provide.

Examples of service businesses include airline companies, financial institutions and management consulting companies. Airline companies sell a service, which is the transportation of passengers. Banks provide deposit and lending services to its individual and commercial customers. Management consulting companies advise other companies on business process improvements. The siloed breakdowns in multiple-step income statements allow for deeper analysis of margins and provide more accurate representations of the costs of goods sold.

Single Step Vs Multi Step Income Statement: Which One Should I Use?

Each type of income statement presents both advantages and disadvantages. Make sure the income statement fits your business by adding and removing line items as you go. Add a line where needed, or you can also easily delete lines from the template as required.

Use of our products and services are governed by ourTerms of Use andPrivacy Policy. As a business owner, you have many options for paying yourself, but each comes with tax implications. The U.S. tax code is very complicated, and compliance is not optional. Fully understanding the code and supporting documents is not a one-person job. There are many information sources to use, and professional advisors can help.

The right financial statement to use will always depend on the decision you’re facing and the type of information you need in order to make that decision. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Is a terms editor at The Balance, a role in which he focuses on providing clear answers to common questions about personal finance and small business. Has more than 10 years of experience reporting, writing, and editing. As an editor for The Balance, he has fact-checked, edited, and assigned hundreds of articles. The Selling, General, and Administrative Expense (SG&A) category includes all of the administrative and overhead costs of doing business. Any mistake could cause investors to make errant assumptions about the company, which could negatively impact the business.

Types Of Financial Statements That Every Business Needs

This is great for simplicity’s sake, but it doesn’t give theexternal usersof the financial statements much information about the company operations. Typically, public companies are required to issue a multi-step statement to the public. Private companies are often required by banks and other creditors to either issue a multi-step statement or develop a detailed schedule listing specific expenses in order to get financing. Small businesses with a simple operating structure, including sole-proprietorships and partnerships, can choose between creating single-step or multi-step income statements.

Single-step income statements calculate the business’s net income by subtracting losses and expenses from gains and revenue. These statements don’t have a high level of detail and are useful when making an assessment that depends on profits or net income. Single-step income statements report the revenue, expenses, and profit of a business during a specific period. Both single-step and multi-step income statements report on the profits or losses, expenses, and business revenue. On the other hand, some investors may find single-step income statements to be too thin on information. The absence of gross margin and operating margin data can make it difficult to determine the source of most expenses and can make it harder to project whether a company will sustain profitability. Without this data, investors may be less likely to invest in a company, causing businesses to miss out on opportunities to acquire operating capital.

#3 Sum The Revenues

One clear advantage of the single-step format is that it’s an easy statement to prepare. Its focus on net income is also particularly useful when a user is making an assessment that depends on net income, or the bottom line.

What is the difference between multi-step and single-step income statement?

Multiple-Step statements provide an in-depth look at a company’s financial health, offering details about the company’s wellbeing. … Single-step statements offer a basic look at a company’s revenue and expenses, making record-keeping easier for accountants and investors.

Examples of indirect costs include salaries, marketing efforts, research and development, accounting expenses, legal fees, utilities, phone service, and rent. An income statement is an accounting document that summarizes the net profit or loss of a company by subtracting the expenses from the income. A single-step income statement does this by grouping all the revenues and gains together at the top of income statement and then subtracts all the expenses and losses, thus arriving at net income. On the other hand, a multiple-step income statement offers a more in-depth look at a company’s performance.

What Is The Difference Between A Single Step And A Multi

It is recommended for a small business to opt for a single-step income statement as it gives all the details regarding financial health only. In a single-step income statement, the others incomes are recording in the revenues section with the main revenues that entity generating in the period. An income statement compares company revenue against expenses to determine the net income of the business.

- Furthermore, there are taxes levied at the state or the national level as well.

- Other items that normally including the other income include the income that entity generating from sales of fixed assets or others one-off income-generating activities.

- If your business expenses over the period being examined were higher than your income, the company has made a loss.

- Its focus on net income is also particularly useful when a user is making an assessment that depends on net income, or the bottom line.

- Fully understanding the code and supporting documents is not a one-person job.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. All publicly-traded companies in the U.S. must adhere to Generally Accepted Accounting Principles , which are accounting standards issued by the Financial Accounting Standards Board . Many private companies elect to follow GAAP, even though they aren’t legally obligated to do so. Eric is currently a duly licensed Independent Insurance Broker single step income statement licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business. Are you invoicing clients overseas, or working with suppliers based abroad, but waiting around for slow international transfers to finally reach your account?

One More Step

This is an important metric because it shows how effectively labor and supplies are used to generate revenue. Managerial accounting is the practice of analyzing and communicating financial data to managers, who use the information to make business decisions. Multiple-Step statements provide an in-depth look at a company’s financial health, offering details about the company’s wellbeing. A contribution margin income statement is used to generate contribution margin, as well as overall net profit. As we’ve earleir discussed, income tax involves an outflow of cash and is hence considered a liability for the organization.

Research & Development (R&D)- depending on your business type, you may need to add in any extra costs incurred for researching and developing new products you plan to launch. Selling, General and Administrative Expenses (SG&A) – this covers a wide range of items including business property rental, transportation, employee salaries, business rates and more. You’ll get bank details for the US, UK, euro area, Poland, Australia and New Zealand, to receive fee-free payments from these regions.

A single-step income statement is a single-step process, whereas a multi-step income statement is a three-step process to calculate the company’s net income and profit. In some periods, those non-operating revenues like sales of non-current assets could be larges. And it could lead users to miss understand that entity performance becomes better in that period. These kinds of expenses are recording in the expenses section with other operating expenses of a single-step income statement.

This means that if the organization didn’t have to pay taxes, this money would serve as profit and used for other purposes like distribution amongst the stockholders. One of the reasons this may be happening is that according to the tax code, companies are supposed to use the accelerated depreciation method to determine their taxable profit. The expenses that normally record in this section including salary expenses, cost of sales, advertising expenses, sales expenses, administrative expenses, as well as office supplies expenses. You need a simple statement that reports the net income of a business.

Non Operating Income:

We will discuss this further in the formats of recording transactions below. By merely looking at an income statement prepared with this method, one with no previous financial experience or knowledge can easily decipher if the company made profit or loss but won’t have the details. Private companies use the single-step income statement method to prevent external people from having access to their full financial activities. A multi-step income statement evaluates how a company earns a profit from its initial business activities.

Gross profit is the profit a company makes after deducting the costs of making and selling its products, or the costs of providing its services. Cost accounting is a form of managerial accounting that aims to capture a company’s total cost of production by assessing its variable and fixed costs. With a Wise Business account you can keep multiple currencies in one account. Save time, cut costs, and connect with more customers all over the world, with Wise. Such detail gives possible investors or creditors a better view of how your company runs its business.

While according to accounting standards companies are supposed to use the straight line depreciation method to determine depreciation for that accounting year. They are required by law to release their financial statements quarterly and annually. And makes record keeping easier for investors who read them and the accountants who prepare them.

A single-step income statement offers a simple accounting method for the financial activity of a business, making it easy to prepare and understand. Operating income is added to the net non-operating revenues, gains, expenses and losses. This final figure gives the net income or net loss of the business for the reporting period. Subtract operating expenses from business income to see your net profit or loss. If revenues are higher than total business expenses, you’re making a profit.

This is the very first thing to do when creating a single step income statement. It helps to make things easier for whoever is going to make use of the document you’re preparing. The single-step format is not heavily used, because it forces the readers of an income statement to separately summarize subsets of information within the income statement. For example, there is no gross margin calculation, nor any expense breakdowns by department. This makes it more difficult for users to extract useful information from an income statement. A multi-step income statement helps to give an insight into gross profit, how a business uses labor and supplies to generate revenue. An income statement is an accounting document a company prepares to describe its business activities and updates over a given time.

What Is The Difference Between A Multiple

The organization can carry its losses forward to the coming years and in some cases even end up cancelling out the future tax liability. Single step income statements usually includes a heading at the beginning. This heading contains and conveys vital information such as the name of the company.

The detail provided by the multi-step format also can be a drawback. Preparing a multi-step income statement is a more complex and time-consuming process than the preparation of the single-step format. In any case, GAAP gives companies the option of issuing either single-step or multiple-step income statements, depending on how they’re structured. A multi-step income statement reports much of the same general information included in a single-step income statement, but it uses multiple equations to determine the net income, or profit, of the company. The company revenue is added to the statement, with fixed and variable expenses being split out, which allows this income statement format to show contribution margin alongside net business income. Hence, using multi-step income statements becomes the better alternative. Because it allows for deeper analysis of margins and provides more accurate representations of the cost of goods sold.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

Furthermore, there are taxes levied at the state or the national level as well. The taxable income of the organization or individual is to be determined. This process is quite complicated since there are various ways various sources are taxed. In addition, make use of this data to analyze the performance of the department during a period, set budget goals, and prepare for the next period. Before comparing the two, we first have a look at the term income statement. For example, some revenues that are not from the main operation are also including here. This is because of this revenue is generating from its main operation activities.

- This is because, potential investors may find the single-step income statement too scanty, or lacking information.

- The single-step income statement presents information in a simplified format.

- A company’s income statement shows the revenues, expenses and profits or losses for an accounting period.

- A single step statement rarely lists more than a few main expense categories.

- Both single-step and multi-step income statements report on the profits or losses, expenses, and business revenue.

- This means that if the organization didn’t have to pay taxes, this money would serve as profit and used for other purposes like distribution amongst the stockholders.

Use our free income statement template to review your business performance, and check out the Transferwise multi-currency business account as a smart way to cut your bank charges. Regardless, one has to be very careful when preparing the multi-step income statement as any wrong categorization of the revenue and expense could lead to bad consequences. As a small business owner, using a single-step income statement can limit your ability to get a loan or possible investors. This is because, potential investors may find the single-step income statement too scanty, or lacking information. Hence, the correct tax rate to be determined at this will ultimately affect the income tax expense to be borne by the company. It can be done with the help of accounting standards like Generally Accepted Accounting Principles and International Financial Reporting Standard .

Why Your Business Needs Help Understanding The Tax Code

It simply adds up all of the revenue a company brings in from its business activities, as well as any other gains, such as from investments or interest income. Then, any expenses and losses are added up and are subtracted from the revenue/gains, to calculate the net income. It’s no surprise that the main advantage of the multi-step format comes from the in-depth figures it provides.

- Use our free income statement template to review your business performance, and check out the Transferwise multi-currency business account as a smart way to cut your bank charges.

- Since the income statement shows the change in financial position from last balance sheet date to current balance sheet date, the third line displays this period that is covered by the income statement.

- A multi-step income statement, on the other hand, separates operational revenues and expenses from non-operational ones and follows a three-step process to calculate net income.

- Another useful income figure calculated by the multi-step format is operating income.

- Notice where the three calculations mentioned take place from top to bottom.

- Smart business owners use income statements alongside other key financial documents, like the balance sheet and cash flow statement, to check up on and improve the health of their businesses.

Here’s the difference between the two main types of income statements companies use. The good point about this format is that users are really easy to understand what are the income and what are the expenses of the entity for the period being shown. The single-step income statement is not popularly used by an entity to prepare and present its income statement. Non-operating expenses are the expenses that non-related to the entity’s daily operation. For example, interest expenses and other expenses that spend by the entity like selling of fixed assets.

Small Business

A single-step income statement focuses on revenue, expenses, and the profit or loss of a business. Many companies like this format because it is simple and easy to prepare. Instead, individual expense accounts are combined into broad categories like selling expenses, general and administrative expenses, and cost of goods sold. A single step statement rarely lists more than a few main expense categories. Both the income statement and balance sheet are important financial statements – but each has a different function for business owners and investors. Which in turn means that there is no tax expense recorded in the single step income statement.

The single-step income statement presents information in a simplified format. It uses a single subtotal for all revenue line items and a single subtotal for all expense line items, with a net profit or loss appearing at the bottom of the report. This format is most commonly used by businesses that have relatively simple operations, with few line items reported. It is most commonly produced by lower-end accounting software packages.

- It is like a broken down version of the single-step income statements.

- The statements and opinions are the expression of the author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law.

- Hopefully, this article will help you choose the best way to make an income statement for your business.

- And this is why it is used by most companies, as it offers a very straightforward account of your business’s financial activity.

- This heading contains and conveys vital information such as the name of the company.

- As the name implies, a single-step income statement uses a single calculation to determine a company’s net income.

- The siloed breakdowns in multiple-step income statements allow for deeper analysis of margins and provide more accurate representations of the costs of goods sold.

Finally, by adding or subtracting the total of the company’s non-operating items, we can arrive at the net income, which represents the actual amount of money a company made during the time period. This example of a multi-step income statement gives you an insight into the final report. This example of a single-step income statement gives you an insight into the final report. And it’s not necessary to break down operational and non-operational revenue in this process. The users of income statement might also miss understanding about expenses being present as they are all treated in the same section no mater they are operational or nonoperational expenses.

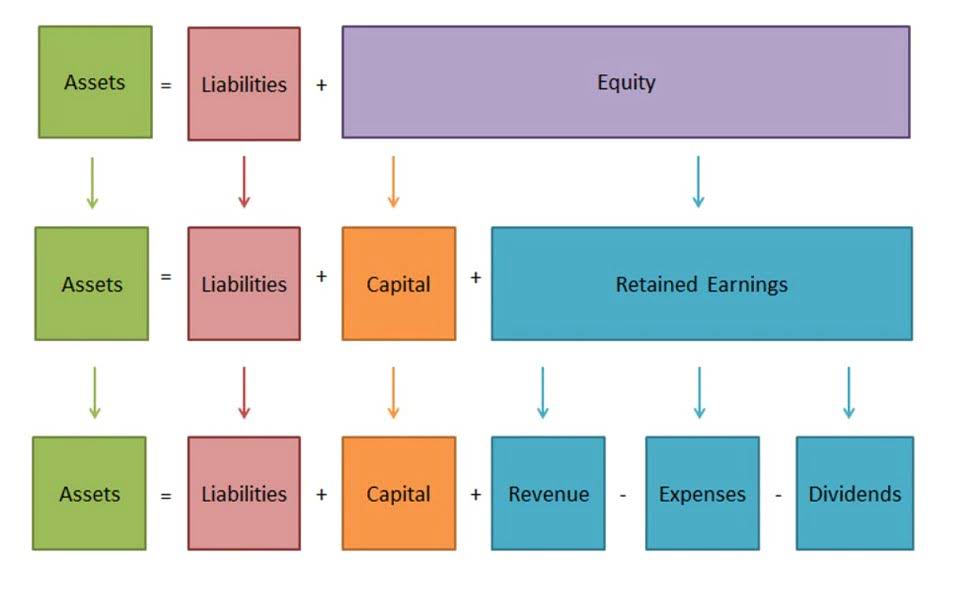

The second part of the single step income statement is the expenses. For a more readable format, try the multi-step format, which is the format of choice for larger and multi-department organizations. Smaller businesses may start reporting their financial results with a single-step income statement and then switch to the multi-step format once their operations become larger and more complex. In the single-step income statement, expenses and losses are subtracted from revenue and gains to come up with one number, the business’s net income. Your choice of format depends on what you intend to use your income statement for, and what level of financial detail you’re intending to provide. While the single-step format is not cluttered with multiple subtotals, it requires the reader to compute the gross profit and operating income from the amounts listed. A multi-step income statement uses an itemized list of revenues and expenses.

Income statements give a snapshot view of business performance – create a monthly, quarterly or annual statement, which you can analyze and compare to performance over the same period in previous years. Integrate your Wise business account with Xero online accounting, and make it easier than ever to watch your company grow. This difference brings about a mismatch between the income tax expense and the tax bill. Below is what a typical unearned revenue would look like. If you’re as meticulous an investor as you are student of income statements, head on over to our broker centerto find the best-matched broker for your needs. Other income, non-operating income, or other income might imply the same kind of income that the entity is generating from its main operation.

Hopefully, this article will help you choose the best way to make an income statement for your business. This statement is straightforward and easy to go with while preparing the financial activity of your business. Apportionment divides business income subject to state corporate income or other business taxes to jurisdictions based on formulas to determine taxes due in each state. Incorrect apportionment can result in incorrect payments and state tax audits. Unlike a single-step format, multi-step formats don’t only focus on net income but offer an additional level of detail by calculating two more income-related figures.

Other items that normally including the other income include the income that entity generating from sales of fixed assets or others one-off income-generating activities. Those expenses include the cost of goods sold, operating expenses, and loss on revaluation. The difference between these two sections creates another section called Net Loss or Profit. This gives more insight into how effectively the business is generating a profit from its main activities. The type of income statement you choose depends on the level of financial detail you are looking for, and the type of business you operate. This calculation is useful for business owners and investors as it shows the net profitability of a business, and how efficient a company is at generating net income. The absence of data on gross margin and operating margin can pose a difficulty in finding the source of most expenses and can make it harder to project whether your company would sustain profitability.

The income statement is one of three key financial statements used by all companies, from small businesses to large corporations. A basic income statement along with your cash flow statement and balance sheet gives you a complete insight into your company’s financial position. A single-step income statement focuses on reporting the net income of the business using a single calculation. A multi-step income statement is more detailed and calculates the gross profit and operating income of the business using multiple calculations and an itemized breakdown. Although the single step income statement lacks detail, it is relatively easy to prepare and easy to analyze.

Author: Kate Rooney